Shanghai, July 11, 2019—China’s auto market is undergoing unprecedented changes. Automakers are not only facing severe challenges such as market saturation, fierce competition, and new forces “disturbing the situation”, but also consumers. profound changes in demand. JD Power’s 2019 China New Car Purchase Intention Study (NVIS) shows that Chinese car buyers’ willingness to own a car, purchase motivation, brand preferences, etc. are gradually changing. Understanding and responding to changes in the needs of potential automotive consumers helps automakers respond to rapidly changing market conditions.

Consumption concept: Automobile consumption tends to be conservative, and consumer demand varies from person to person

The economic level of consumers determines their purchasing behavior. The rapid growth of China’s new passenger car market for more than ten years has benefited from the scale of the industry and the improvement of the national economic level. However, the current Chinese economy in the transition period has caused a great impact on national income. Certain pressure.

The conservatism of the overall consumption behavior is transmitted to the field of automobile consumption. This year’s new car purchase intention study (NVIS) shows that Chinese consumers have become more conservative in automobile consumption. Their car purchase budget has been tightened by 12% compared with last year, down to 210,000 around yuan.

The study also found that consumers’ purchasing motivation is mainly based on elastic demand. Automobiles are a commodity with relatively high price elasticity. If the demand side is squeezed by the budget, the pressure is likely to be transmitted to the price on the supply side, which will exacerbate the industry’s difficulties.

The 2019 China New Car Purchase Intention Study (NVIS) draws the latest consumer portraits based on behavioral attitude tests and background data, and divides potential car consumers into four categories. This result is expected to provide a reference for the market positioning and advertising of brands and products.

· Practical and refined style: not very interested in cutting-edge technology and fashion, and pay attention to cost performance. I don’t have a lot of knowledge about cars, and I just use it as a common product. I prefer international car brands, and I have the highest interest in new energy vehicles. The behavior of buying a car is fine.

· Rational Conservative: It is more rational to treat the price. The attitude towards auto finance is the most conservative, and quality/durability is the most important thing when purchasing a car.

Functional view: The demand for configuration is increasing, and the prospect of customized services is promising

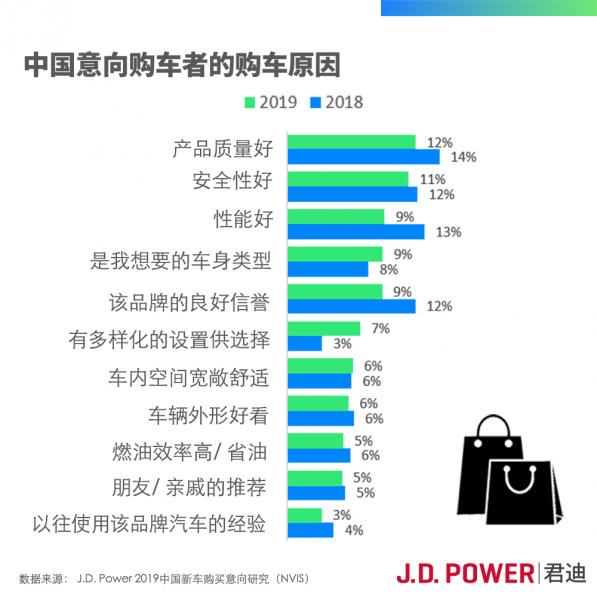

As consumers have a richer and deeper understanding of configurations, “rich optional configurations” has become one of the main driving factors for consumers to purchase vehicles, and the importance of configuration richness among consumers’ car purchase factors has jumped from the 11th place Ranked 6th.

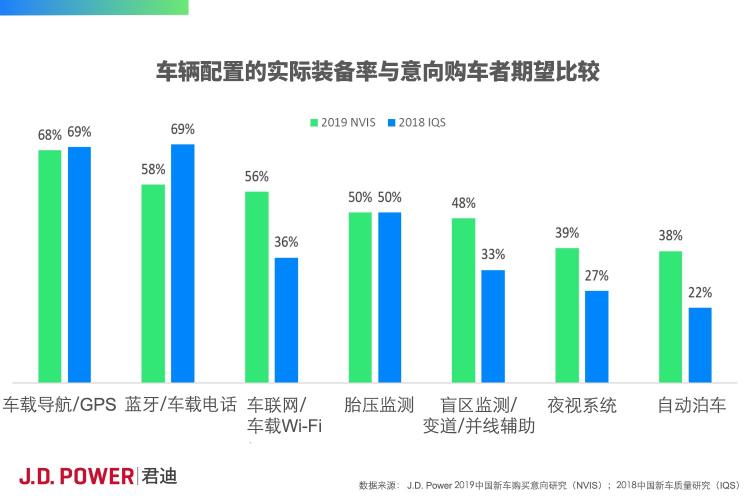

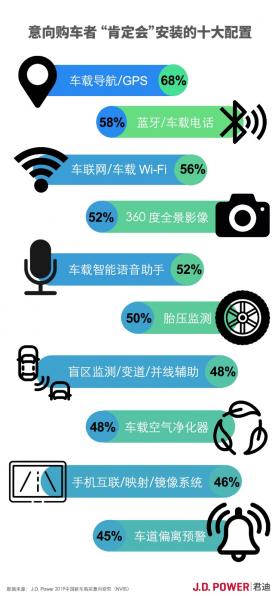

Among the many configurations, the top three configurations with the highest consumer demand are all multimedia configurations, which are car navigation/GPS, Bluetooth/car phone, and Internet of Vehicles/car Wi-Fi, which are closely related to their daily use frequency and available scenarios. relevant.

Compared with relevant data of the JD Power 2018 Initial Quality Study (IQS), the actual assembly rate of high-demand multimedia configurations such as car navigation, Bluetooth/car phone, etc. has reached user expectations. However, there is still a certain gap between the actual assembly rate of popular configurations such as Internet of Vehicles, blind spot detection, night vision systems, and automatic parking, and consumers’ expectations.

Consumers’ demand for configuration usually increases with the increase of budget. Studies have shown that when consumers’ car purchase budget exceeds 100,000, their expectations for configuration will increase significantly, but it is difficult for this budget range to cover most configurations or certain configurations. High-end configuration. Therefore, OEMs need to rationally configure or provide customized services on the product line according to the actual demand rate of consumers to meet the needs of different consumers.

Brand concept: Self-owned brands are blooming in more places, and there is still a gap between new power car companies

The 2019 China New Car Purchase Intention Study (NVIS) shows that the share of potential car buyers of self-owned brands ranks first among all car series with 40% share, and the share of potential car buyers of most self-owned brands has increased to varying degrees. Although self-owned brands still have a slight gap with other car brands in terms of quality, performance, and safety, they have grown against the trend in terms of shape, design, and product experience, and have created their own advantages. However, due to the large number of independent brands, the competition within the department is very fierce.

In terms of brand image, although some new car companies have initially established a smart and forward-looking brand image, due to the late start of brand establishment, the overall brand image is not clear enough, and the differentiation is not obvious. In this regard, Tesla’s brand image building is relatively more successful, and it is currently the leader among new car-making forces.

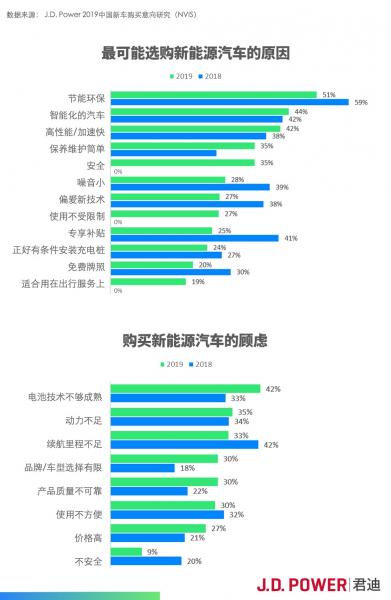

New energy vehicles have not yet become a new market pillar, and less than 10% of consumers prefer new energy vehicles. But its basic function to respond to market demand is mature. With the deepening of consumers’ understanding of it, new energy vehicles still have huge potential to be tapped.

Research shows that half of consumers mainly use cars for short-distance commuting in urban areas, and the proportion is constantly rising. This is a usage scenario that new energy vehicles can cover and have cost advantages. Therefore, consumers’ anxiety about the mileage of new energy vehicles is also gradually decreasing. JD Power’s research on China’s new car purchase intentions shows that the concern of car buyers about “insufficient mileage” has dropped from 42% last year to 33% this year. As consumers have a deeper understanding of new energy vehicles, in addition to obvious factors such as environmental protection, intelligence, and low noise, consumers have gradually realized the advantages of new energy vehicles in maintenance.

However, the current series of electric vehicle safety stories have caused consumers to question the reliability of the product, and the number of car owners who are worried about “immature battery technology” and “unreliable product quality” have increased to 42% this year (+9% %) and 30% (+8%). In addition, affected by the expected decline in new energy vehicle subsidies, subsidies are no longer the main focus of new energy vehicle demanders. Therefore, this period of time is a huge test for companies. How to improve consumer confidence and solve consumer pain points is a problem that companies need to solve.