Guan Impression (Source: Guan Impression Official Website)

Guan Impression is one of the most prestigious tourism performing arts brands in China. It owns works familiar to tourists such as “Impression Liu Sanjie”, “The Most Reminiscing is Hangzhou”, “Seeing Pingyao Again”, and “Zhiyinhao”. Ordinarily, this should be a cash cow. However, Sanxiang Impression, the parent company of Impression, suffered a huge loss of 1.154 billion yuan a year due to Impression.

Not only the people who eat melons can’t understand this matter, even the regulatory authorities can’t understand it. On May 28, the Shenzhen Stock Exchange issued an inquiry letter to Sanxiang Impression, sending 14 questions in a row, questioning the rationality of Sanxiang Impression’s goodwill impairment of 1.154 billion yuan in 2018, and “whether there is a situation of profit adjustment”, “Zhang Yimou, Whether Wang Chaoge and Fan Yue’s three-year service will affect their business operations after their three-year service expires.”

Not only that, Guan Impression also staged a major change in performance, failing to fulfill its performance commitments for three consecutive years, especially in 2018, it originally promised to contribute a net profit of 163 million yuan, but actually only completed 27 million yuan, which was less than a fraction of the promise. In this regard, the inquiry letter also raised a question, “Detailedly explain the reasons why Guan Impression has not fulfilled its performance commitments for three consecutive years and its performance has fallen sharply in this period. Please explain whether the above factors are predictable, and whether they have been considered in the process of reaching the previous restructuring plan. ?Did your company’s board of directors and independent financial advisor perform their duty of diligence and responsibility during the acquisition process?”

The original brand and excellent reputation became a “scandal” in the capital market only three years after it was acquired by the real estate company “Sanxiang Co., Ltd.” How did all this happen?

Impression = wealth management products?

Impression Impression was once the embodiment of perfection. It was established in 2006. Its predecessor was Beijing Impression Culture and Art Center initiated by three directors Zhang Yimou, Wang Chaoge and Fan Yue. With their high artistry and innovative ability, the three directors created the first domestic live-action performance “Impression Liu Sanjie”, the first domestic indoor scene performance “See Pingyao Again”, and China’s first drifting multi-dimensional experience drama “Zhiyinhao”. , have aroused strong reactions from the market.

The innovation of Guanyin is not only the product itself, but also a brand-new practice of the world’s original art varieties. In terms of business, it has created a cultural industry model with Chinese characteristics. Therefore, Impression Impressions has also won the favor of top investment institutions during its development. IDG, Jack Ma’s Yunfeng Fund, etc. have invested in Impressions Impressions.

“Impression Liu Sanjie” (Source: Guan Impression Official Website)

Outstanding artistic innovation, popular market reputation, top-level director lineup, and the blessing of star investment institutions have achieved a perfect viewing impression.

In July 2015, Sanxiang Co., Ltd., a listed company originally engaged in real estate, acquired 100 shares of Guanyin for 1.9 billion yuan in order to find a new industry direction. In order to express the determination of transformation, Sanxiang Co., Ltd. subsequently changed its name to Sanxiang Impression.

It is easy to buy a company, and it is also easy to change its name, but real innovation and industrial management capabilities cannot be bought. Losing the impression of the artist’s full dedication, it is more like a financial product at this time. The operation mode of Guan Impression is completely different from that of another major domestic tourism performing arts brand “Songcheng Performing Arts”. Songcheng Performing Arts makes the whole industry chain from creation, performance to theater operation by itself, and all the tickets received are packed in their own pockets. . Impression Impression is a copyright authorization model. After the three directors of Impression Impression have created the program, they will authorize it to other companies at one time, teach them to perform skillfully, and then draw a certain amount of operating water and maintenance fees from the tickets, usually for the tickets. 105 of income

Therefore, after Sanxiang Impression acquired Guan Impression, there is almost no need to do anything, and it is enough to collect money from the operating companies of various performances on a regular basis. At the same time, according to the agreement, from 2015 to 2018, the net profit attributable to the parent company of Guanyin should not be less than 100 million yuan, 130 million yuan, 160 million yuan, and 163 million yuan respectively. Guan Impression has served for 3 years. Within 3 years, Wang Chaoge and Fan Yue each developed a new play.

Currently, Impression Impressions has performed, produced, and signed 17 projects, which is equivalent to Sanxiang Impression buying the copyrights of 17 performances for 1.9 billion yuan, and getting a certain percentage of the tickets for 17 performances every year.

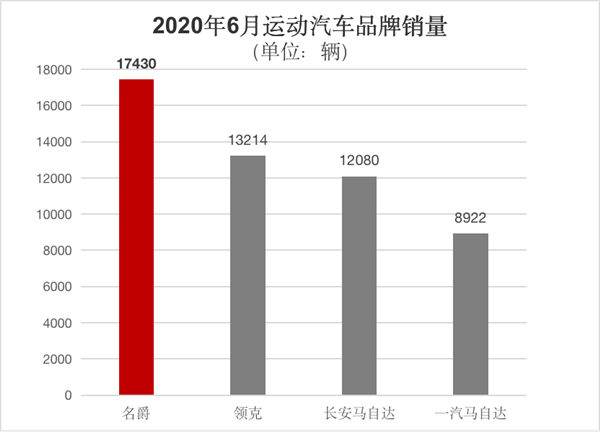

Promised profit of 163 million completed 27 million

Undoubtedly, this is the fastest and safest way for real estate developers to transform into cultural tourism, but even so, Sanxiang Impression still overturned. On the one hand, when the three-year period is up and the artist leaves, whether Guanimpression has the ability to continuously launch new works, or whether the new works will be paid for by the market, is a big question mark.

On the other hand, according to the original profit promise, the annual profit contribution of 160 million yuan will be maintained. According to the cost of 1.9 billion yuan, the return will be 8 per year. From the perspective of financial management, it is not a big profit, but it is not a loss either. Unexpectedly, in 2018, Guan Impression only made a profit contribution of 27 million yuan, and the total copyright income of 17 works was only 27 million yuan in profit, which is shocking.

“Impression Lijiang” (Source: Guan Impression Official Website)

With such a severe profit decline, even Voxen (Beijing) International Assets Appraisal Co., Ltd. couldn’t sit still. The company issued an asset appraisal report when Guanyin was acquired, predicting that Guanyin will contribute 162 million net profits in 2018 . According to Workson, there are three main reasons for the unfulfilled performance forecast: first, some companies are operating unfavorably, and the performance of some projects has been postponed, resulting in the impression that the audience did not receive the box office share as agreed; second, the state strengthened local Government debt management. Affected by this, some projects in creation were not completed and production fees were charged, and the impression was that the original creative team was lost, new projects were undertaken less, and production fee income declined; third, some project maintenance agreements expired, and projects The company did not renew the contract with Impressions, and the macroeconomic environment declined. Some project companies tightened maintenance fee expenses, resulting in a decrease in the impressions maintenance fee income.

Worksun said, “The above situation is an accidental event that the appraiser could not know and predict beforehand and could not control afterwards. In view of the fact that the net profit of Guanyin’s operating performance in 2015-2018 did not reach the predicted value, this appraisal agency and the signing asset appraiser have this to say. I am deeply sorry and hereby sincerely apologize to all investors.”

Due to the above changes, Impression Impressions obviously cannot continue to maintain a high valuation of 1.9 billion yuan. In the 2018 annual report, Sanxiang Impression cut off the valuation of 1.154 billion yuan directly, leaving only 690 million yuan. Due to such a slash, Sanxiang Impression’s performance has changed drastically, with a net loss of 460 million yuan in 2018. If the net loss of 1.035 billion yuan is deducted from non-recurring gains and losses, it can be described as a heavy loss.

So here comes the question, did the two parties really not expect this result at all when they made such a deal? In fact, it is difficult to say “yes” or “no”. Guan Impression is a company with many investment institutions as shareholders. If investment institutions want to pursue high returns, they must not wait to collect copyright fees year after year. High returns can only come from listing or being acquired at a high premium. Therefore, Guanyin has a strong motivation to sell at a good price, and usually this good price comes from a listed company.

In 2015, asset-light transformation was popular. As long as listed companies announced the transformation of asset-light, shareholders often strongly supported it. The stock price could increase several times. It cost more than one billion to acquire, and the company’s market value increased by tens of billions. Make a profit. In March 2015, Sanxiang Impression announced its acquisition plan. Within less than a month, the stock price rose from 6.4 yuan to 18.8 yuan, an increase of nearly three times.

China’s first drifting multi-dimensional experience drama “Zhiyinhao” (Source: Guanyin official website)

There is nothing quicker than this to make money. The seller gets a satisfactory premium, and the soaring stock price of the acquirer can easily cover this premium, and the stockholders get hype and carnival.

But the carnival always comes to an end. After all, the “financial management products” bought cannot replace the hard work of entrepreneurial innovation and meticulous operation. Without solid industrial capabilities, Sanxiang Impression, whether it is real estate or cultural tourism, will inevitably decline. In 2016, Sanxiang Impression had a revenue of 6.7 billion yuan. In 2017, it was only 2.5 billion yuan, and in 2018 it was further reduced to 1.6 billion yuan. billion.

It’s just a pity that the once shining impression is becoming an empty shell. “Capital is what boosts you, and you have to pay it back after all.” The words of Hu Weiwei, the founder of Mobike, are also very appropriate for Guan Impression. Capital once boosted impressions, and later impressions fulfilled capital’s desire for returns at the cost of sacrificing the “soul”.