Shanghai, September 6, 2019 – JD Power, the world’s leading consumer insights and market research organization, released the China Initial Quality Study (IQS) for the 20th consecutive year. The results show that the quality of new cars in China’s auto industry has improved significantly. How to interpret the quality reversal in the sluggish auto market? What value and rewards will be brought by sticking to the quality gate in difficult times? Wang Qinghua, joint research director of JD Power China, brought a wonderful interpretation.

2019 is the 20th anniversary of IQS entering China, during which JD Power has witnessed the rapid development of the Chinese auto market. Looking back in 2000, the sales volume of passenger cars was only over 1 million, but in 2019 it has exceeded 20 million. In the past 20 years, the compound annual growth rate of passenger vehicles in China has exceeded 20%.

IQS is a research system that grows together with the Chinese market. Through 20 years of hard work, IQS has become the quality evaluation system that more and more domestic OEMs rely on. The core indicator of this system is the number of problems per 100 vehicles (PP100), which has a clear downward trend. In 2000, the overall score of China’s auto industry was 500 PP100, but this year this number has dropped to below 100.

Sales “cold winter” has become quality “spring”

The improvement of the overall quality seems to be inconsistent with the declining sales trend, but from another perspective, this result is an intuitive reflection of the changes in the automotive market environment.

In 2018, China’s auto industry experienced negative growth for the first time. Under the general trend of negative growth, strict quality control of auto manufacturers is an inevitable choice to deal with the cold winter, which has further improved the overall quality performance of the industry. JD Power’s research in the United States also found similar findings – 2008 and 2009 were the two years with the largest sales decline in the U.S. auto market in decades, but they were also the two years when the U.S. auto industry showed the greatest improvement at that stage.

“In the process of sales decline, maintaining or even expanding market share by improving quality is probably a way for OEMs to save the decline.” Wang Qinghua concluded.

In addition, the improvement in the quality level of the industry this year is also the result of the improvement of China’s automobile manufacturing capabilities. JD Power’s auto production plant awards released in the United States show that although the top rankings are mainly North American and Japanese factories, the manufacturing plant in Yantai, China has performed well and won silver and bronze awards, which means that products made in China are in the United States. The market is doing well, and the manufacturing capabilities of Chinese factories are improving.

Adhere to the quality gate in difficult times: the sea is flowing, and the heroic qualities will be revealed

According to JD Power’s research, there are seven major factors that affect sales: product quality, product design, price, dealer network, dealer service, brand and macro market. Quality, as one of the seven elements, has an impact on sales that cannot be underestimated.

Looking back at the two years of China’s new car quality research in 2018 and 2019, 64 brands have data available in these two years of research. The total sales volume of these 64 brands represents 99% of the market share. Based on the analysis of these 64 brands, we can see the driving effect of product quality improvement on sales share.

The average PP100 of the 28 brands with increased sales was 92 points in 2019, which was better than the industry performance, while the other 36 brands with reduced sales were 103 points, which was far worse than the industry average. Although both groups of brands have improved by 10 PP100 compared to 2018, the magnitude of progress is different. The former achieved an improvement of 9.8%, while the latter only achieved an improvement of 8.8%. In other words, those who were originally excellent worked harder. The 9.8% improvement in PP100 brought about a 9.3% increase in absolute market share for these 28 brands.

Quality improvement does not happen overnight, nor can it drive sales immediately, but in difficult market times, car quality will definitely have a very important and positive impact. Wang Qinghua said: “‘Only when the sea is flowing, can a hero show his true qualities’. Sticking to the quality barrier will definitely have good results, and the value of sticking to it will be reflected in the increase in sales share.”

Good thing, the gap is smaller; bad thing, the competition is fiercer

In 2019, self-owned brands scored 101 PP100, and international brands scored 92 PP100, the gap between the two reached the smallest in history. Self-owned brands respond to the market more quickly and make decisions faster, which is a basis for continuous progress. But whether the water in this pool can jump over is a test for independent brands. A few years ago, JD Power predicted that the quality of Chinese independent brands would catch up with international brands in 2018 and 2019. This estimate now looks a little optimistic.

The quality gap is getting smaller, which means that the competition will be more intense

Not only independent brands, but under the current market situation, international brands are also actively making adjustments, giving the domestic market more independent research and development, design and decision-making power, and at the same time catering more to the characteristics and needs of Chinese consumers. Therefore, it can be seen from this year’s IQS data that the quality of cars in various car series has improved.

This progress is also reflected in the gap between mainstream brands and luxury brands. This year, the gap between mainstream cars (97 PP100) and luxury cars (81 PP100) narrowed to 16 PP100. With the development of vehicle quality, the gap between mainstream cars and luxury cars is bound to become smaller and smaller. We have already observed this phenomenon in the US market.

“The narrowing of the gap between independent brands and international brands, the narrowing of the gap in the quality of cars in different countries, and the narrowing of the gap between mainstream cars and luxury cars means that the future competition will be more intense. How do leading brands maintain their dominant positions and how do rising stars catch up? , are worthy of consideration by OEMs.” Wang Qinghua concluded.

The car-machine system is expected to overtake on curves

IQS is a rigorous system, divided into eight categories (seats, body decoration, air conditioning system, driving experience, body appearance, configuration/control and instrument panel, engine transmission system, audio/communication/entertainment/navigation) 233 questions, Based on this system, the performance of each vehicle is evaluated. Among them, the problems of body interior, appearance and engine transmission system are relatively consistent with those of previous years. The interior of the body has been improved, but the appearance and transmission system have declined compared with last year. The main reason is that the proportion of first-time car purchases in 2019 has increased, and there are more car owners with inexperienced driving and car use, so there are more complaints about traditional problems.

Focus on audio/communication/entertainment/navigation (ACEN), we collectively refer to this category as “car-machine system”. This year, the car-machine system has been improved by 2.9 PP100, which is one of the most improved categories among the eight categories. What is more noteworthy is that there is no difference between self-owned brands and international brands at the vehicle level, while mainstream brands perform better than luxury brands. It can be seen that the car-machine system is likely to be a category that can achieve overtaking in curves, and Chinese car companies have more advantages in meeting consumer needs, especially in terms of experience.

The car-machine system has made great progress and may become a category for overtaking on curves

With the deepening of the “four modernizations” of automobiles, more and more technical products and technical configurations will be loaded into vehicles in the future. A well-designed car-machine system that is close to the user experience will help car companies get more praise from consumers.

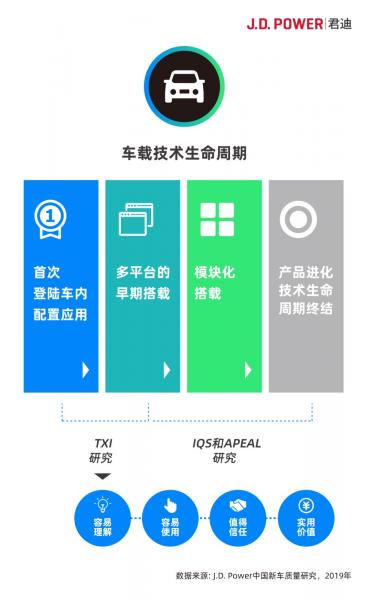

Introducing Technology Experience Research (TXI) to address new technology challenges

More configurations may lead to more problems while bringing comfort. Therefore, in the new platform next year, JD Power will introduce a new technology experience research (TXI). Low-rate products, technical features, and technical configurations are included in this research, and the impact of these advanced technical settings on consumers is evaluated from the dimensions of its practical value, whether it is easy to understand, whether it is easy to use, and whether it is trustworthy. When a certain configuration becomes the mainstream configuration and exceeds a certain market share, it will be introduced into the IQS platform for further evaluation, which not only takes into account the technological development, but also ensures the fairness of the evaluation.