The 2019 China Auto Sales Satisfaction Study (SSI) released by JD Power, the world’s leading consumer insights and market research organization, shows that competition in new car sales is no longer limited to dealerships. At the early purchase decision stage, the rate of customer churn has gradually increased, and about a quarter of potential car buyers have given up buying before entering the dealership.

This is the 20th consecutive year that JD Power has conducted auto sales satisfaction research in the Chinese market. The research focuses on evaluating the satisfaction of new car buyers and defeated customers with the car buying experience. A loser is someone who visited a dealership but ended up buying a car elsewhere. Research shows that although the service experience in the dealership is still the main reason for customer churn, its proportion has dropped from 90% in 2017 to about 70% (74%) this year, and the proportion of customer churn that occurred before entering the store 26%, up from 10% in 2017.

The study also found that consumers do not have a deep understanding and experience of the product before entering the store, so purchasing decisions are easily influenced by subjective impressions, prices or public opinion. The main reasons for the loss of customers before entering the store are that the vehicle is not suitable/unsatisfactory, the brand/model is too expensive, and the brand/model has many negative reviews.

Ren Hongyan, Vice President of Digital Customer Experience of JD Power China, said: “Consumers’ purchasing decisions are affected before they enter the store. Allowing users to experience products and services at an early stage can enhance users’ direct perception and help consumers establish Build goodwill and trust in the brand, and form word-of-mouth communication. Sales staff should put the test drive and service experience in front, and start the sales communication with the experience invitation, which will help to avoid the loss of customers due to price and public opinion.”

Poor communication between sales staff and users is another reason for the loss of customers before entering the store. The specific performance is that sales staff do not really understand the needs, give greater purchase pressure, service is not enthusiastic enough, and prices are not transparent.

“Obtaining brand information through various communication channels is a direct way for consumers to quickly understand the brand. The more humane response and faster response speed of service personnel can effectively improve customer experience, which can not only effectively reduce customer loss, but also grasp customers. The good timing of the demand can ease the pressure of in-store service and improve operational efficiency.” Ren Hongyan believes.

Here are other findings from the study:

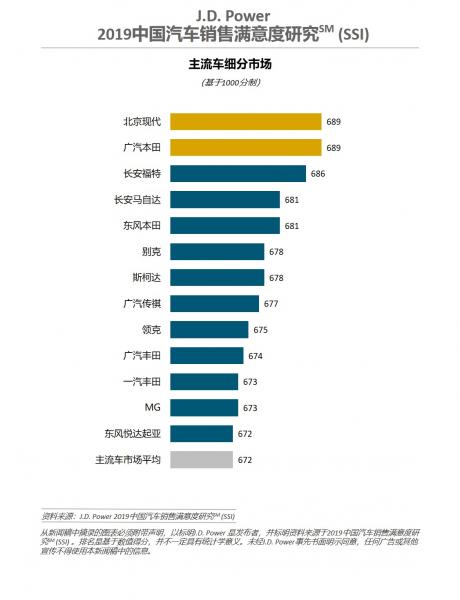

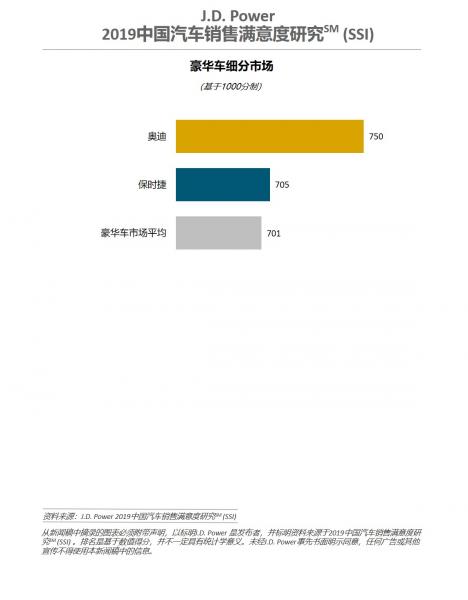

· The sales satisfaction of luxury cars is significantly higher than that of mainstream cars: the overall sales satisfaction index of the industry in 2019 is 677 points. Luxury brands (701) are significantly ahead of mainstream brands (672) in satisfaction. Self-owned brands (666) have the lowest sales satisfaction among different car series.

· Satisfaction with official online information channels of automakers is higher: Although the official online information channels of automakers are not as influential as third-party online channels when consumers buy cars, consumers are more satisfied with the former (+ 12 points), especially in the provision of vehicle information. Automakers should strengthen their own advantages in information provision, enhance user stickiness, and further enhance consumers’ online experience.

· Third-party car purchase platforms are actively involved in the purchase and transaction process, and have a positive impact on customer experience: Third-party car purchase platforms other than traditional dealers have shown certain influence in determining models, negotiating/determining transaction prices, and delivering new cars. In addition, the customer satisfaction of car buyers who use third-party car buying platforms is 23 points higher than those who buy cars directly at dealerships.

2019 China Auto Sales Satisfaction Ranking

Audi ranked first in sales satisfaction in the luxury car segment for the seventh consecutive year with a score of 750. Porsche ranked second with 705 points.

Beijing Hyundai and GAC Honda tied for first place in the mainstream car segment with 689 points, and Changan Ford (686 points) ranked third. GAC Trumpchi (677 points) is the No. 1 Chinese independent brand.

The JD Power 2019 China Auto Sales Satisfaction Study (SSI) evaluates the overall satisfaction with the new car purchase experience of car owners who have purchased a car for 2 to 6 months. The overall consumer satisfaction index is composed of the car purchase customer index and the defeated customer index. Among them, the car purchase customer index includes online experience (15%), sales staff (19%), dealer facilities (19%), transaction process (16%), written documents (15%) and car delivery process (17%) factor; The Lost Customer Index includes online experience (20%), dealership facilities (21%), variety of available models (22%), sales staff (17%), price transparency (11%) and price negotiation experience (11%) %) six factors. Sales satisfaction is calculated using a 1,000-point scale.

The 2019 study was based on responses from 23,197 car owners who purchased a new vehicle between July 2018 and May 2019. Data collection was carried out in 75 major Chinese cities between January 2019 and July 2019.