On March 6, 2020, JD Power (Jundi) officially released a survey report on the impact of the new crown pneumonia epidemic on consumers’ willingness to buy cars. The survey aims to help the auto industry understand the impact of the COVID-19 epidemic on Chinese consumers’ willingness to buy cars and considerations for car purchases, and provide a basis for them to formulate sales and service strategies, so as to better cope with the huge impact of the COVID-19 epidemic.

This survey adopted an online survey method, and the sample collection work was carried out from February 24 to February 28, 2020, and a total of 1,992 valid samples were recovered.

The survey found that the enthusiasm of some consumers to buy cars was stimulated to a certain extent by the impact of the epidemic. However, most consumers are still relatively rational in their decisions on car purchases, and it is unrealistic for the market to pin its hopes on a rebound in consumer demand in the short term to usher in a recovery in the auto market. Secondly, under the influence of the epidemic, while car buyers pay attention to quality and performance, air safety and health in the car have become another focus of consideration. In addition, the demand for online car purchases and dealer online services continues to increase, and the attention to health configurations continues to rise. Accurately grasping changes in consumers’ car buying psychology and needs can help improve sales success and service satisfaction.

Let us use charts and data to interpret the changes and changes of Chinese consumers under the influence of the epidemic one by one:

1. Affected by the epidemic, the willingness to travel by public transport has decreased significantly, and the proportion of private car travel has remained basically unchanged

Under the influence of the epidemic, the willingness of the respondents to choose public transportation for travel has decreased significantly; online car-hailing travel has also been affected to a certain extent; the willingness to choose private cars for travel is relatively consistent with the usage before the outbreak of the epidemic, and there has been no significant fluctuation.

The means of transportation used by the surveyed consumers before the outbreak vs. the means of transportation they tend to use before the epidemic is effectively controlled (n=1992)

2. Nearly half of car buyers without plans are considering buying a car, and 1/4 of car buyers who plan to buy a car ahead of schedule

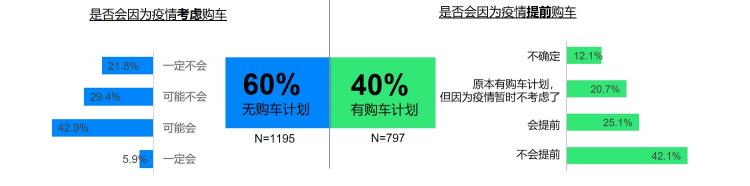

Affected by the epidemic, nearly half (48.8%) of the respondents who had no plans to buy a car said they would “probably” or “definitely” buy a car; among the respondents who originally planned to buy a car, 1/4 clearly stated that they would For car purchases in advance, 40% (42.1%) said they would not buy cars in advance, and another 1/5 of the group who originally planned to buy a car canceled their car purchase plan due to the epidemic.

The proportion of car purchases considered due to the epidemic and those purchased in advance due to the epidemic

3. Consumers are considering buying a car, but not in a hurry

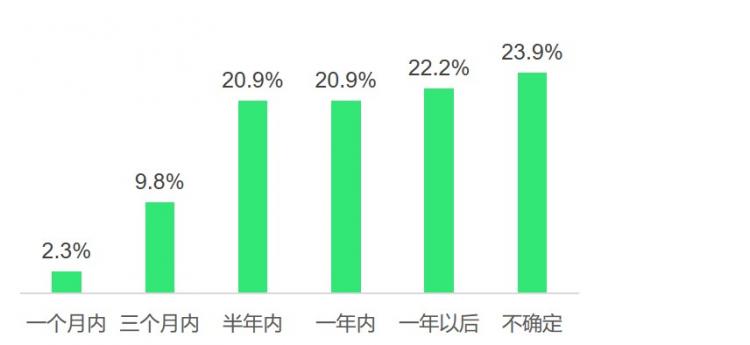

Among the respondents who plan to buy a car, only 30% (33%) plan to buy a car in the next six months. Twenty percent (22.2%) of the respondents set the car purchase time in one year, and another 23.9% said they were not sure about the car purchase time. It can be seen that in the short term, it is difficult for the auto industry to usher in a turnaround in the auto market by relying on a rebound in consumer demand.

Planned car purchase time of interviewed intentional car buyers (n=1212)

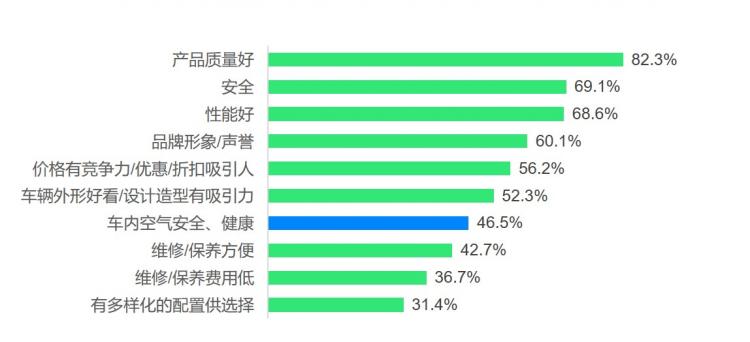

4. Quality and safety are still the key considerations when buying a car, and air safety in the car has become another key consideration

The top three considerations for Chinese consumers when buying a car are quality (82.3%), safety (69.1%) and performance (68.6%). ). Manufacturers use the health and safety of the air in the car as a selling point to help grasp the psychology of consumers.

TOP 10 car purchase considerations of the interviewed intentional car buyers (n=1212)

5. Intended car buyers expect various types of health features and configurations

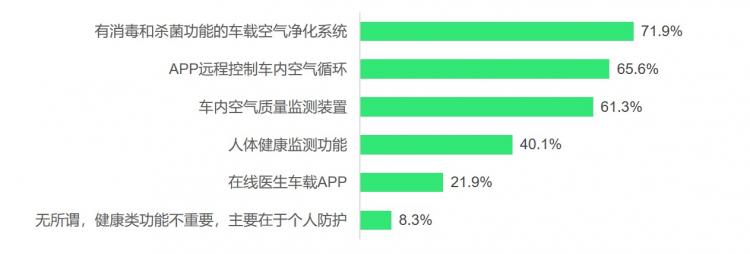

Vehicle air purification systems with disinfection and sterilization functions (71.9%), APP remote control of in-vehicle air circulation (65.6%) and in-vehicle air quality monitoring devices (61.3%) are the health functions and configurations that car buyers are most concerned about.

Health functions and configurations that users will pay attention to when buying a car (n=1212)

6. Online sales methods such as watching cars in VR and selling cars through webcasting are popular

Affected by the epidemic, various online car purchase methods have become an inevitable choice for consumers. VR car viewing (44.2%), which was originally only used as an auxiliary way to buy cars, was favored, and online car selling (36.8%) became a hit. The combination of online car viewing and door-to-door test drive service provides manufacturers with new sales ideas. However, it should also be noted that 30% of the intended car buyers still rely heavily on viewing cars in physical stores.

Sales methods attractive to potential car buyers (n=1212)

7. Car owners hope to add air purification and health configurations in the car

The interviewed car owners also hope to add air purification and air quality monitoring devices in the car. In addition, health-related functions and configurations such as human health monitoring functions and online doctors are also increasingly valued by car owners.

The health functions and configurations that car owners want to install on their private cars (n=1195)

8. The importance of manufacturers’ online service capabilities and digital capabilities is highlighted

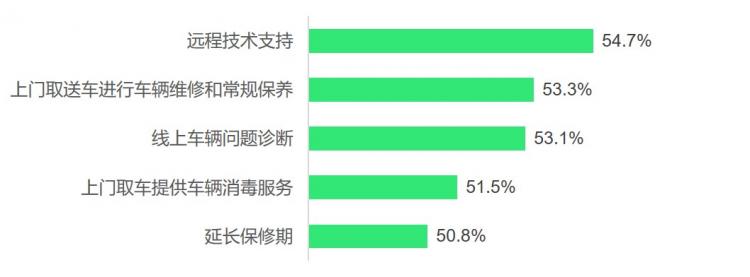

In special times, car owners hope that car brands and dealers will provide remote technical support (54.7%) and online vehicle problem diagnosis services (53.1%) to minimize the frequency of store visits. The demand for online services puts forward higher requirements on the digital capabilities of manufacturers. In addition, 50% of car owners expect dealers to provide door-to-door car maintenance or disinfection services. Dealers should seize the opportunity of door-to-door services to create new service demands.

What car owners expect from brands and dealers during the epidemic (n=1195)

Although the outbreak of the epidemic has made the auto industry even worse, the special period is the best time for automakers to practice their internal skills, seize the opportunity to improve and improve online sales and service capabilities and other digital operation capabilities, and become an automaker. One of the urgent tasks.