The 2019 China Auto Service Satisfaction Study (CSI) recently released by JD Power, the world’s leading consumer insight and market research organization, shows that more than 70% of car owners will make an appointment before entering the store for maintenance in order to obtain faster service, but the service efficiency after entering the store failed to make car owners feel the benefits of making an appointment.

JD Power 2019 China Auto Sales and After-sales Service Satisfaction Research Press Release and Awards Ceremony Guests Group Photo

The research shows that nearly 30% of car owners (28%) encounter difficulties when making an appointment, and the most common problems are “can’t make an appointment at a suitable time”, “reservation conditions are harsh” and “the reservation system is not easy to use”. In addition, after arriving at the dealership, the advantage of making an appointment is not fully reflected. It takes an average of 23.1 minutes to start the service, which is longer than the 21.1 minutes waiting time for car owners without a reservation. The study also found that more than 40% (41%) of reservation users hope to make an appointment with the car dealer at the most suitable time for them, and 40% of reservation users expect to start service directly after arriving at the dealership.

Su Jun, President of JD Power China

Wang Qinghua, Research Director of JD Power China

Ren Hongyan, Vice President of Digital Customer Experience at JD Power China

Ren Hongyan, Vice President of Digital Customer Experience of JD Power China, said: “Dealers set up an appointment system to promote various services in an orderly manner, but judging from the actual appointment experience and service waiting time of car owners, the appointment system has not played its due role. Efficacy. Authorized dealers should strive to optimize the rational allocation of resources, realize the full-process service connection from reservation to departure, and bring out the advantages of the reservation system.”

This year’s research also shows that compared with authorized dealers, the service efficiency advantage of independent after-sales channels is more obvious. Among them, the proportion of car owners who can start service immediately after arriving at independent after-sales channels is higher than that of car owners at authorized dealers, and the overall service time is 18 minutes shorter than that of authorized dealers.

“Authorized dealers’ control of service quality and details is temporarily unmatched by independent after-sales channels, but service efficiency is a weak point. From this perspective, improving appointment services and improving service efficiency will also help reduce users. The loss of after-sales channels.” Ren Hongyan thinks.

Here are other findings from the study:

The number of mileage driven has decreased and the number of visits to the store has decreased: Compared with 2018, the mileage driven by private cars has decreased by 18%, and the loss of authorized dealers has increased, and the number of consumers visiting authorized dealerships has dropped from 3.4 times in 2018 to 2019 2.8 times, a drop of 17%. The trend was most pronounced among those born between 1980 and 1984, where the drop reached 25%.

The rate of loss of car owners to independent after-sales channels is accelerating: In 2017, car owners first chose independent after-sales channels in the 17th month after purchasing a car.

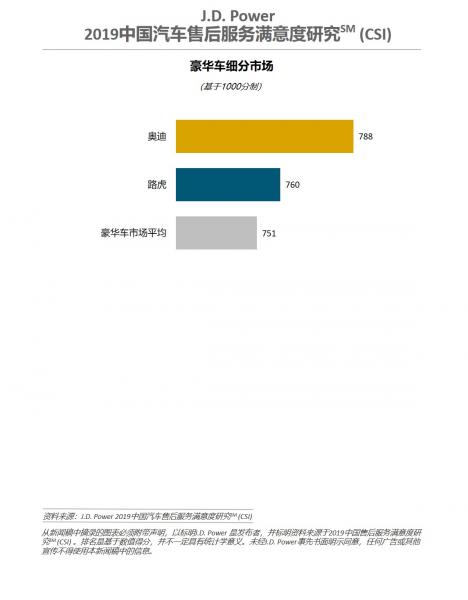

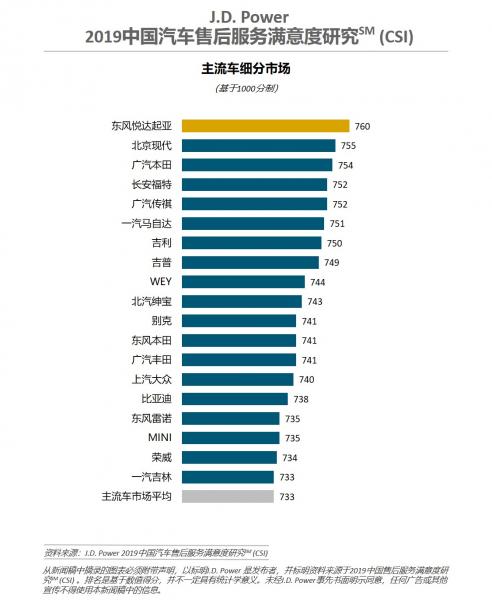

The overall satisfaction gap between the mainstream car market and the luxury car market has narrowed significantly: in 2019, the industry’s overall after-sales service satisfaction index was 736 points. The gap in after-sales service satisfaction between mainstream car brands (733) and luxury car brands (751) narrowed from 56 points in 2018 to 18 points.

Dealerships need to be cautious in temporarily recommending new service items: increasing the number of single service items to increase the unit price of customers is one of the sales strategies of dealers, but if the suggestion of adding items does not meet the real needs of car owners, they will face rejection (20% ) and the risk of decreased service satisfaction.

2019 China Automobile Service Satisfaction Ranking

Audi ranked first in the after-sales service satisfaction list of the luxury car segment with a score of 788. Land Rover ranked second with 760 points.

Dongfeng Yueda Kia ranked first in the mainstream car segment with 760 points, Beijing Hyundai (755 points) and GAC Honda (754 points) ranked second and third respectively. There are four self-owned brands in the top ten mainstream car segments, namely GAC Trumpchi (752 points), Geely (750 points), WEY (744 points) and BAIC Senova (743 points).

JD Power 2019 China Automobile Service Satisfaction ResearchSM (CSI) has entered its 19th year. The study measures vehicle owners’ satisfaction with dealer service department repair or maintenance services among owners of vehicles between 13 and 48 months. This period of ownership is often an important part of the vehicle warranty period. The study determined overall after-sales service satisfaction by measuring five factors including “service initiation” (22%), “service advisor” (19%), “service quality” (21%), “dealer facility ” (20%) and “delivery after service” (19%). Automobile after-sales service satisfaction scores adopt a 1,000-point system.

The 2019 study was based on responses from 35,718 car owners who purchased a new vehicle between January 2015 and June 2018. Data collection was carried out in 71 major Chinese cities between January 2019 and July 2019.