Shanghai, July 31, 2019 – JD Power, the world’s leading consumer insight and market research organization, today released the 2019 China New Energy Vehicle Experience ResearchSM (NEVXI). Research shows that new energy vehicles face both traditional quality problems and unique quality problems of new energy vehicles, and solving the two major quality problems of new and old is the key to improving product competitiveness and winning consumers’ favor for new energy vehicles.

2019 is the first year that JD Power released the China New Energy Vehicle Experience Study. The study focuses on the quality problems encountered by new owners of new energy vehicles with a vehicle ownership period of 2 to 6 months. The new car quality score is expressed by the average number of problems per 100 vehicles (PP100). , indicating that the fewer the number of questions, the better the quality. The study also examines the user’s complete experience and satisfaction during pre-sales, sales and product use.

The research shows that the complaints of new energy vehicle owners are mainly traditional quality problems, and the top three types of problems with the most complaints are body interior (16.3 PP100), body appearance (15.8 PP100) and driving experience (14.7 PP100). In contrast, users’ complaints about batteries and electric motors, the core components unique to new energy vehicles, are relatively low among all issues, with only 7.4 PP100 and 3.4 PP100 respectively.

As far as the unique quality problems of new energy vehicles are concerned, consumers’ complaints mainly focus on four aspects, namely insufficient power (2.7 PP100), too slow charging speed (1.9 PP100), and abnormal reduction in cruising range (1.8 PP100). PP100) and power system abnormal sound (1.4 PP100).

Cai Ming, general manager of JD Power China’s automotive product division, said: “With the weakening of policy support for the new energy vehicle market, consumers’ attention to new energy vehicles will shift more to the product itself. The quality of new cars is a product competitiveness. It is one of the important factors in decision-making and car purchase, which to a large extent determines which side consumers will lean towards when faced with traditional fuel vehicles and new energy vehicles. In the current market environment is still relatively favorable, new energy vehicles While developing the core technology of new energy vehicles, car companies cannot ignore the solution to traditional quality problems. The simultaneous resolution of the two types of quality problems is not only a test for new energy vehicle manufacturers, but also an opportunity to win the favor of the market and consumers. “

Other findings from the study:

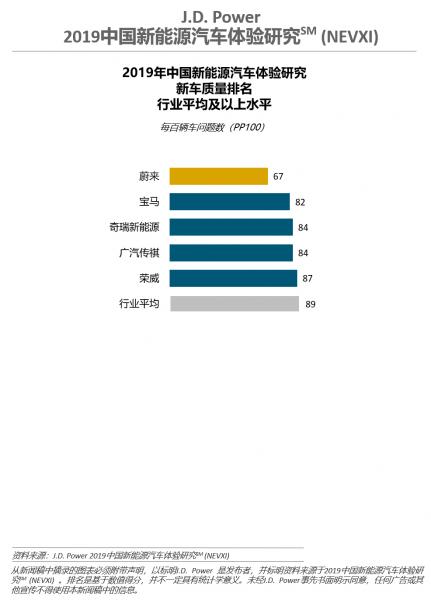

The luxury new energy vehicle brand has the lowest number of quality problems (69 PP100): the overall new car quality of the industry this year is 89 PP100, the independent new energy brand has the most problems (90 PP100), and the independent new power brand[1] has the least number of problems (65 PP100).

New energy vehicle owners are generally satisfied with the performance, operation and design of the vehicle (7.5 points, calculated on a 10-point scale): the highest score is appearance/shape/design (7.6 points), followed by the driving experience of the vehicle (7.5 points points) and interior design/color matching/materials (7.5 points), battery performance and entertainment/technology configuration are relatively low (7.4 points).

The experience of the smart car system needs to be improved: car owners do not use the smart car system extensively, and still stay in basic scenarios such as listening to music, listening to the radio, navigating, and making calls. The smart application scenarios of cars need to be explored and developed. For example, the study found that 64% of car owners have never used the OTA air update function since buying a car. In addition, car owners also have complaints about the experience of using the smart car system, such as few functions (31%), unsightly interface (26%), poor network signal/slow network speed (19%), system crash/stuck (16% )Wait.

Top-Rated Makes and Models

Weilai (67 PP100) and BMW (82 PP100) rank first and second in the quality of new energy vehicles. Chery New Energy (84 PP100) and GAC Trumpchi (84 PP100) tied for third.

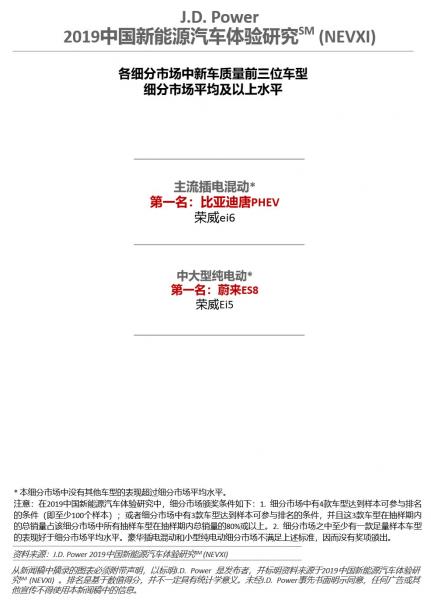

In terms of market segments, BYD Tang PHEV won the first place in the mainstream plug-in hybrid market segment, and NIO ES8 won the first place in the large and medium-sized pure electric market segment. The luxury plug-in hybrid and small pure electric segment markets did not meet the segment award criteria, so no awards were presented.

The 2019 China New Energy Vehicle Experience Study (NEVXI) clearly divides new energy vehicle quality issues into two categories: design defects and failure/inoperability. Specific diagnostic questions include the following nine categories: body interior, body appearance, electric motor/transmission system, driving experience, battery, configuration/control/instrument panel, seat, audio/communication/entertainment/navigation and air conditioning system.

The study is based on real-world feedback from 2,770 car owners who bought a car between September 2018 and March 2019. The research covers 41 models of 21 brands, and the data collection was carried out in 30 major Chinese provinces between March 2019 and May 2019.

[1] The research only includes two independent new force brands, NIO and WM.