Shanghai, March 26, 2020 – JD Power, the world’s leading consumer insight and market research organization, today released the 2020 China New Car Purchase Intention StudySM (NVIS). Research shows that as Chinese consumers visit less dealerships during the car selection stage, the decision-making process accelerates, and brand influence and early interaction between brands and consumers become more critical.

The research on China’s new car purchase intention has entered its twelfth year. The study focuses on the intended car buyers’ perceptions and attitudes towards car brands, the brands and models they are considering buying, car buying considerations, information sources, and their interest in new technologies. Intended car buyers refer to consumers who plan to buy a car in the next 12 months.

The study found that the car purchase decision of the intended car buyers gradually moves forward, and the decision-making process is accelerated. In 2020, intended car buyers visited 1.65 brand dealerships, down 8% from 1.79 in 2019. Additionally, the average number of dealerships visited by would-be car buyers dropped 17 percent from 3.5 in 2019 to 2.9 in 2020.

The JD Power China Auto Sales Satisfaction Research (SSI) also shows that, faced with a large number of optional models on the market, consumers are gradually shifting from focusing directly on models to focusing on brands first and then deciding on models. The number of consumers who have locked in the brand they intend to buy at the initial stage of purchase has increased year by year, from 10% in 2016 to 18% in 2019.

Wang Qinghua, general manager of joint research of JD Power China, said: “The reduction in the number of times consumers enter the store during the purchase stage and the order of the model before the brand is determined highlight the influence of brand influence on car purchase decisions. Auto brands should strive to be in the Consumers’ brains are occupied in the early stages of car selection. At the same time, due to the impact of the new crown pneumonia epidemic at this stage, the number of potential customers entering the store to see cars may be further reduced. Brands rely more on digital retail methods such as live broadcast car sales and potential This also requires brands and dealers to cherish every opportunity to have direct contact with customers, and use better service experience to drive potential consumers to make purchasing decisions.”

Other findings from the study:

The influence of vehicle configuration on purchase choices is increasing year by year: the proportion of potential car buyers who choose the desired model because of configuration has increased from 17% in 2016 to 43% in 2020. According to the needs of potential car buyers, vehicle configurations can be divided into three categories: high-demand configurations represented by navigation and holographic images, and configurations that help form differentiated marketing represented by blind spot monitoring/lane keeping and adaptive cruise control. Marketing configuration, as well as experience configuration equipped in high-end models and car series.

Potential car owners’ demand for safety equipment has increased significantly: the demand for safety systems (such as active braking, night vision systems, 360-degree holographic images, etc.) of intended car buyers has increased significantly (+10%) compared with last year, higher than that of assisted driving functions, Multimedia configuration and use/experience features.

Consumers’ car purchase budget has declined for two consecutive years: the car purchase budget of intended car buyers has dropped from 244,000 yuan in 2018 to 201,000 yuan this year, a drop of as much as 18%.

The willingness to purchase new energy vehicles has risen for five consecutive years, and purchase concerns still exist: Consumers’ willingness to purchase new energy vehicles surpasses that of small cars, MPVs and luxury sedans jump to the third type of vehicle they tend to buy, second only to SUVs and mid-sized cars car. “Insufficient cruising range” (25%) and “immature battery technology” (21%) are still consumers’ main concerns about new energy vehicles.

Intended car owners of self-owned brands seldom consider other brands: mainstream international brands generally have a high intention to purchase, but most of their potential car buyers will consider other brands at the same time. Although the intention-to-purchase rate of self-owned brands is lower than that of mainstream international brands, their potential customers are more exclusive to other brands and have higher brand loyalty.

research ranking

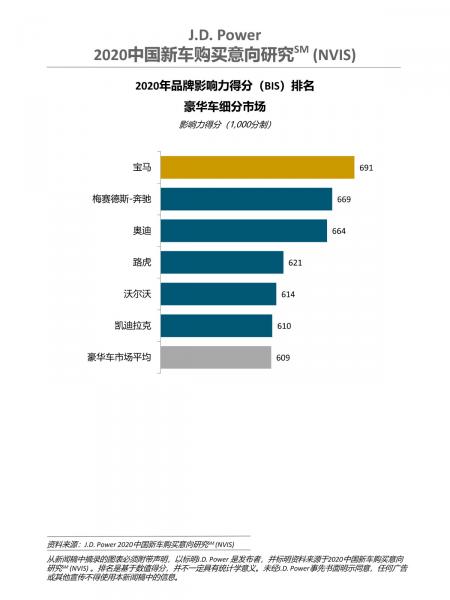

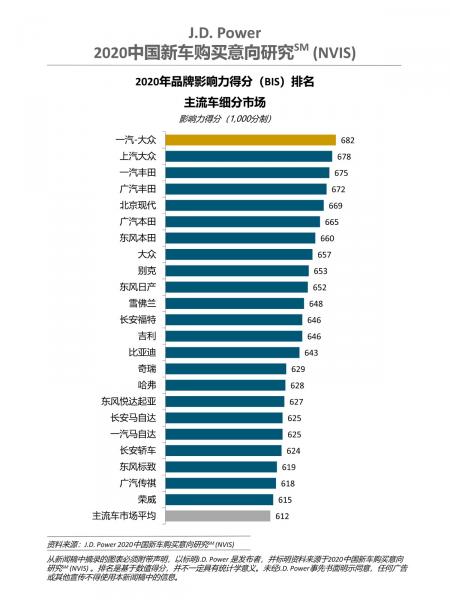

The study also included the Brand Influence Score (BIS), which is a comprehensive evaluation index based on brand awareness, brand familiarity and brand liking (on a 1,000-point scale).

Among luxury car brands, BMW (691 points) has the highest brand influence score, while Mercedes-Benz (669 points) and Audi (664 points) rank second and third. Among mainstream car brands, FAW-Volkswagen (682 points) has the highest brand influence score, followed by SAIC Volkswagen (678 points) and FAW Toyota (675 points).

The 2020 China New Vehicle Intention Study (NVIS) is based on feedback from 11,881 intended car buyers, covering a total of 66 brands. Data collection for this study was conducted through an online survey from December 2019 to January 2020. The data collection for the study was carried out before the widespread outbreak of the new crown pneumonia epidemic, so it does not reflect the direct impact of the epidemic on car purchase intentions.