Japanese brands take the top three places in dealer satisfaction, and FAW Toyota wins the championship again

April 23, 2020, Shanghai – JD Power, the world’s leading consumer insight, data and analysis organization, officially released the 2020 China Auto Dealer Satisfaction Study SM (DAS) today. Research shows that in fiscal year 2019, dealer revenue and profits continued to decline. Since 2020, affected by the new crown pneumonia epidemic, dealers have faced unprecedented pressure; manufacturers have increased support for dealers, especially new car sales, It will help the two sides work together to tide over the difficulties.

The JD Power China Auto Dealer Satisfaction Study (DAS) began in 2009. The study systematically measured dealers’ perceptions and attitudes towards manufacturers from the perspective of the auto industry and distribution network, and analyzed the closely watched issues of manufacturers and dealers. Various problems. All information for this study was obtained from the top management of the interviewed dealerships.

The research shows that in fiscal year 2019, the financial pressure of the interviewed dealers continued to increase, and the total revenue decreased by 5% to 175 million yuan. The revenues of the three major business segments of new car sales, after-sales service and spare parts, which are the main sources of income for dealers, all showed a downward trend. In addition, compared with the previous fiscal year, the total profit of dealers has shrunk by 19%, from 2.83 million yuan in fiscal year 2018 to 2.28 million yuan in fiscal year 2019. Among them, the contribution rate of after-sales service and parts to overall profit has declined. Three percentage points, after-sales profitability has shrunk further.

Since the outbreak of the new crown pneumonia epidemic, the dealer’s pre-sales and after-sales business has been greatly impacted. A supplementary survey on the impact of the epidemic on the interviewed dealers found that in February 2020, each interviewed dealer sold an average of 14 new cars, 16% of the dealers had zero sales, and the average inventory depth of a single store increased from 1.84 before the epidemic. It rose to 2.6, and the inventory pressure increased by 41%. In terms of after-sales, the number of service desks entering the market per month is less than 100 units, which is 85% lower than before the outbreak.

Ren Hongyan, vice president of digital user experience at JD Power China, said: “The impact of the epidemic on the auto market is far from fully manifested, and dealers must be prepared to fight a protracted war. In the case of reduced revenue, cost reduction and efficiency increase will become the next step. Important issues. At the same time, the changes in consumer demand and behavior brought about by the epidemic require dealers to work hard to improve their business capabilities such as online marketing and contactless services. However, these cannot be achieved only by dealers alone. A community of interests, manufacturers strengthen support for dealers, including support for marketing and sales activities, and support for digital business, will help both parties work together to tide over the difficulties.”

Other findings from the study:

The total revenue of new car sales declined but the profit contribution rate increased: the total revenue of new car sales of dealers dropped from 154 million in FY2018 to 147 million in FY2019, but the contribution rate of new car sales to total profit increased from 20% in FY2018 to 23% in FY2019. Improved inventory status (-13%) and higher sales rebates (+13%) are the main reasons for the increase in profitability of new car sales at dealerships, but the number of new car sales is still on a downward trend (-8%).

The profitability of after-sales service continues to weaken: In fiscal year 2019, dealers’ monthly visits to service stations and the number of base customers both showed a 16% decline compared with fiscal year 2018, and the annual income of dealers’ after-sales service business increased from 7.6 million yuan in fiscal year 2018 That fell to $7.2 million in fiscal 2019, and components revenue fell to $3.2 million from $3.8 million in the previous fiscal.

The online marketing business of dealers has stagnated, and the proportion of dealers who have set up online marketing departments has declined for three consecutive years: the customer flow and transaction volume brought by online marketing to dealers have not exceeded 30% for five consecutive years, because dealers have obtained online sales leads. There is no effective tracking and conversion; the stagnation of business has in turn affected the enthusiasm of dealers for digital marketing. The proportion of dealers who have set up online marketing departments has dropped from 93% in 2017 to 83% in 2020.

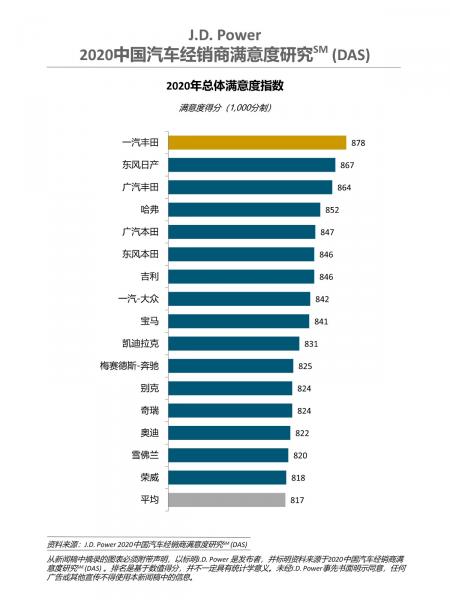

2020 China Auto Dealer Satisfaction Research Ranking

This year’s top three dealer satisfaction is dominated by Japanese brands. FAW Toyota (878 points, total score 1,000 points) won the championship consecutively, Dongfeng Nissan ranked second with 867 points, and GAC Toyota (864 points) ranked third.

JD Power China Auto Dealer Satisfaction Study (DAS) evaluates auto dealers’ satisfaction with brand manufacturers, and is an effective tool to measure the health of the relationship between manufacturers and dealers and a reference for manufacturers to evaluate dealers and adjust business policies . The study is based on eight metrics that make up dealers’ overall ratings of vendors: vendor support (30%), training (12%), sales force (12%), after-sales team (11%), Marketing and sales activities (11%), parts supply (10%), products (7%) and vehicle ordering and delivery (6%). Dealer satisfaction scores are scored on a 1,000-point scale. This year’s study surveyed 2,125 dealers in 85 cities, covering 46 brands. The data collection was carried out from December 2019 to March 2020, and 718 dealers were accepted from March to April 2020. Supplementary survey on the impact of the new crown pneumonia epidemic.